Here are some suggestions on how to handle these questions to help your buyers address the real issue, “Is now a good time to buy for me?”

Question #1: I heard prices may continue to fall – why should I purchase a home now?

The answer: Price is not the only consideration.

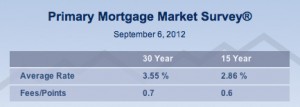

Even though the market is going UP in many places, some are still worried about a potential collapse. Homebuyers worried about falling prices need to think about the total cost of their loan and the interest rates that drive them. Buyers who try to second-guess the market may end up paying much more over the long run.

For example, a buyer who purchases today for $375,000 with 20% down will have a mortgage of $300,000. If they lock in at a rate of 4% fixed for 30 years, monthly payments will be $1,432.25 and the total cost of the loan will be around $515,610.00. *

If the buyer holds off and prices drop five percent, he or she could save about $70 per month. However, if the prices drop five percent and interest rates climb just one percent, that waiting buyer will pay about $97 more each month and $35,168 more over the life of the loan.

I’ve seen so many buyers try to second-guess the market and fail. And there is always a price tag associated with that failure – sometimes a hefty one.

Tip: If you want to do this calculation for your buyers, you don’t have to be a loan expert. Download Trulia’s new free Mortgage App for the iPhone and iPads and check out the mortgage calculator.

Question #2: If I buy now, when can I expect to see appreciation?

The answer: Be brutally honest, no one really knows. Initial projections showed appreciation could start nationwide in 2014. Recently this date was pushed back to 2016 and anyone currently watching the market knows that in many places prices have actually started going up in the past few months. The problem is, we don’t know how long this growth will be sustained.

Historically, buyers didn’t purchase homes because of the potential for appreciation in value. Freedom from tyrannical landlords was at the top of the list.

Unfortunately, after the housing collapse that began mid-2006, the idea of appreciation is now firmly cemented into most homeowner’s minds.

Buyers whose primary goal is potential appreciation need to sit with you and write out a list of buying “Pros and Cons” to help make the decision – and, price appreciation shouldn’t be on the list.

Question #3: “Is it better to rent or buy?”

The answer: It totally depends on WHY you are buying.

If your buyers can make their projected mortgage payments and the monthly bottom-line is their focus, recent research shows it’s 45 percent cheaper to buy.

If you’re working with house hunters who are looking for short-term gains or quick profit, tell them they shouldn’t bother.

For buyers looking to be free of rental restrictions and petulant landlords, want the ability to renovate to their heart’s content, want to benefit from the significant income tax deductions and can afford the monthly payments, it’s a great time to buy.

Ultimately, the decision to buy is a big one and there’s no blanket answer for the house hunting masses. The best thing any agent can do is give their clients the truth and show them the decision to buy is (and has always been) personal.

Save yourself some time. Incorporate these suggestions into your responses when you’re first meeting to help your buyers make the hard call.