Today’s Primary Mortgage Market Survey® (PMMS) compiled by Freddie Mac showed a slight decrease or stay in mortgage rates. If you are in the market to buy a home, now is an excellent time to lock in a great rate for purchasing a home.

Today’s Primary Mortgage Market Survey® (PMMS) compiled by Freddie Mac showed a slight decrease or stay in mortgage rates. If you are in the market to buy a home, now is an excellent time to lock in a great rate for purchasing a home.

Continued low interest rates create more opportunities for home buyers who can qualify.

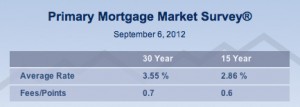

- A 30-year fixed-rate mortgage currently averages 3.55% (with an average 0.7 point) in comparison to last week’s 3.59% and the 4.12% fixed rate mortgage offered at this time last year.

- The 15-year fixed rate mortgage remained the same, at an average 2.86% (with 0.6 point), versus the 2011 15-year fixed rate of 3.33%.

- The 5-year Treasury-indexed hybrid adjustable-rate mortgage was down slightly, as well, averaging 2.75% (with 0.7 point) instead of last week’s 2.78% and last year’s 2.96%.

- The 1-year Treasury-indexed adjustable-rate mortgage dropped a bit, too, coming in at 2.61% (including an average 0.4 point), rather than 2.63% one week ago and the 2.84% seen in 2011.

Frank Nothaft, Freddie Mac Vice President and Chief Economist explained, “Mortgage rates were little changed over the holiday week amid mixed economic data releases. Although consumer spending rose 0.4% in July, representing the largest gain in five months, the core price index was unchanged suggesting little threat of inflation. Consumer confidence picked up slightly in August according to the University of Michigan, but remained below this year’s peak in May. And the manufacturing industry contracted for the third consecutive month in August.”

So, taking all that into consideration, now may be the perfect time for you to sell or buy a home. Call or email me to find out the latest news, get pre-approved, or find out about available homes for sale in our community. I’d love to help you with your real estate needs!